Election polls open in

DAYS

HRS

MINS

FIND MORE ELECTION NEWS

More news

Kgosi Mampuru II correctional staffer's homes gutted in fire at housing precinct

Phepsi the new Siya? Sharks coach Plumtree reckons the experiment has promise

A tale of two campaigns: How two former presidents seek to canvas votes in ANC vs MK Party battle

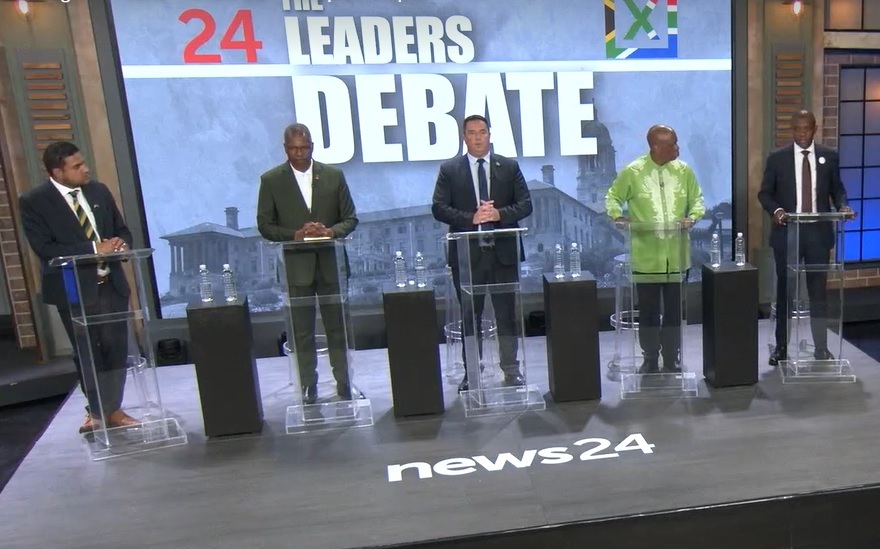

WATCH | News24 Leaders Debate: IFP, Rise Mzansi vow not to enter coalition deal with ANC

Player welfare, national duty sacrificed at football gluttony altar: 'It's not good, not normal'

Life

South Africa

Do you have any complaints or feedback about News24's content? Here's how to get in touch

Any complaints, queries or suggestions about content on News24 may be sent to our public editor George Claassen.

WATCH: Lesufi slammed for his NHI electioneering 'lies'

Enyobeni Tavern report: Parents vindicated by the SA Human Rights Commission’s probe

WATCH | News24 Leaders Debate: Let voters decide which party must govern, Mashaba tells Steenhuisen

Good News: Shining a light on the bold, brave, glass-half-full people keeping SA going

Business

'Wake-up call:' BHP's proposed Anglo mega deal kicks SA to the kerb

BHPs proposed takeover wants Anglo to get rid of its poison-pill South African assets, and analysts say it should be a wake-up call for the country.

Clicks pharmacy licence conundrum: Govt deal is imminent, says CEO

Absa names Deon Raju as financial director in executive shakeup

Pieter du Toit | Last rites for Sir Ernest’s Anglo American? From global giant to BHP target

In big blow to Gordhan, botched SAA deal referred to SIU

Sport

live

URC teams and fixtures: Bulls name Smith at 10, Stormers' Harris reaches milestone

Fixtures, teams, and results from Round 15 of the United Rugby Championship.

Ronza's rallying cry to Mzansi football fans: 'Let South Africa as a whole get behind Sundowns'

Boks vs Ireland encroaching on storied All Blacks rivalry? Hold yer horses, says Irish great

Hulkenberg to leave Haas to join Sauber at end of F1 season

'Sad and painful': Shabalala wakes up every day knowing Chiefs are in a period of pain

Entertainment

Streaming of Showmax's Roast of Minnie Dlamini gets off to rocky start

Showmax's first roast featuring Minnie Dlamini starts off with a hiccup, missing its morning premiere. But the streamer promises laughs galore, confirming its...

'Horrified': Hollywood stars outraged at overturning of Harvey Weinstein's sex crimes conviction

REVIEW | The Fall Guy is an absolute blast, if you can forgive the messy plot

Here’s why Angie and Brad are nowhere near settling their messy divorce battle

Back with a bang: MaBlerh 'excited' for RHOD Reunion encore as host of upcoming 2-part Showmax saga

World

live

DEVELOPING | Ahead of feared Rafah invasion, Palestinians mourn bombardment dead

Israel is at war with Hamas, after a surprise attack from the Gaza strip.

'They lied': Frustrated Qatar hits back at Israel-Hamas mediation criticism

China warns US of 'downward spiral' in relations, in top-level talks on Russia, trade, and Taiwan

UPDATE | Ukraine jails agriculture minister pending probe into graft allegations

Harvey Weinstein's conviction overturned by top New York court

Africa

Benin, Liberia, and Sierra Leone also roll out malaria vaccine

Three more African countries have joined a rollout of malaria vaccines targeting millions of children in a continent that accounts for 95 percent of malaria deaths,...

Burkina Faso army executed over 220 villagers in February, Human Rights Watch says

Tanzania denies rights abuse after World Bank suspends funds to R2.9 billion tourism project

US negotiates for 'orderly and responsible withdrawal' of troops from Niger, as Russia moves in

118 inmates escape after rain damages Nigerian prison

Arts + Culture

From Secunda to stardom: SA opera singer Innocent Masuku's journey to Britain's Got Talent glory

Nkululeko Masuku shares his triumph as SA's newest rising star, who went from Mpumalanga to global fame, wowing BGT judges and setting the opera world ablaze.

Lawyer by day, hero by heart: Clark Kent lookalike becomes beloved Superman in Brazil

Theatre with a purpose: Finding the Light at the Artscape left audiences breathless

Trial by Media: Opera about Oscar Pistorius court case is as weird as it sounds

Metropolitan Museum of Art unveils a new vision: Celebrating 3000 years of African heritage

Relationships

Is smart the new sexy? The complex truth behind intelligence and attraction

From studies to personal stories, here's why a sharp mind might just be the key to unlocking true love.

Why boxing coach Simon Domingos turned to Mzansi Magic's Date My Family to find love

Conversations of courage inspired by compassionate Kate: Talking to kids about cancer

My father's infidelity: Learning the warning signs - and the qualities I do not want in a partner

Simone Biles defends her husband amid calls for her to divorce him for his viral comments

Motoring

Driving Kia's first electric car in SA: UK has its own problems, but local EV ownership isn't bad

Gary Scott delves into the realities of driving the lone Kia EV6 in South Africa, where electric mobility faces different challenges but remains an enticing prospect.

PICS | Calling all Ayrton Senna fans: You could own the F1 icon's Honda NSX for a cool R12 million

Kia's SA-bound Tasman bakkie could create a storm for Toyota Hilux, Ford Ranger

SEE | More big-name vehicles discontinued in South Africa in 2024

Fiat’s Oltre is the Italian double-cab 4x4 everyone forgot

Wellness

What the hack? The TikTok cleaning tips that promise shine but deliver potential danger

TikTok's viral cleaning hacks might do more harm than good. Uncover the truth behind the scrubbing scams and find safer, effective alternatives for a sparkling home.

From beer pong to wedding songs, Cape Town couple share their love story and dreamy disco wedding

Paralysed not broken: Inga Mkoko shares resilient rise after losing legs in Soweto tavern tragedy

'Trying not to drown': Halle Bailey's relatable revelation about navigating new motherhood

Scott Disick admits he's gone too far with weight loss drug Ozempic

Books

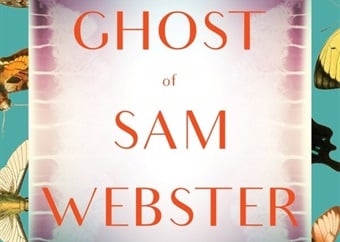

Coming to FLF: Craig Higginson to talk about writing, readers – and ghosts

The Ghost of Sam Webster is at once a war novel, a murder mystery, a multi-layered love story and a reassertion of what it is to remain human during the most...

REVIEW | Womb City: A speculative fiction and horror novel of anxiety, trauma, and hope

A literary feast: More than 150 authors in 80 sessions await at annual Kingsmead Book Fair

Coming to FLF: Champion Caster Semenya on her inspirational memoir, The Race to Be Myself

'Look a little bit further': Ivan Vladislavic on Jo'burg life and his new book, The Near North

Wine

WINE BUSINESS | What would Stoffel do? Under the Influence in Africa

The revolutionary digital wine training and distribution company, Under the Influence, celebrates its 16th year in Africa this year.

FEATURE | Capensis: In search of the 'purity of light'

WINE 101 EVENTS | The plight of Australian wine and Australian Young Gun Wines in SA

RATINGS | The Sylvia Plath of SA Chardonnay: Draaiboek Wines

FEATURE | In defence of the Eastern wind: The resurrection of Vriesenhof

Travel

Travelstart launches new members-only app: Here’s how its perks and benefits stack up

Travelstart's new membership programme makes big promises - here's what it's offering at launch.

How much it costs to use the fast-track security lanes in SA airports - with or without a bank card

Five changes to look out for on your next visit to The Saxon

Exploring the history, ancient baobabs, and vast birdlife of Kruger’s fabled Pafuri region

Bumped from a flight? Learn all about airline overbooking in South Africa and your rights as a...

Food

Mother-daughter team celebrates heritage and culture with the launch of Razia’s Pickle

Meet the new head chef at Jan Hendrik van der Westhuizen's restaurant in the Northern Cape

A porky brunch affair: 10 delicious recipes to try

Steyn City's dining hot spot: Café del Sol serves up modern Mediterranean comfort food

Autumn’s bounty: A celebration of seasonal apples

City Press

Sars reviews R1.1m tax claim against rapper Khuli Chana's company

Khulane Morule is happy that a payment arrangement has been concluded between the revenue collector and his company, and has learnt his lesson.

WATCH: Lesufi slammed for his NHI electioneering 'lies'

Former ASA boss Terrence Magogodela pays back R400k of ill-gotten Lotto money

Lack of load shedding before polls a happy coincidence, but don't pack away your candles yet

Mbeki takes Soweto by storm as he re-affirms support for the ANC

Partner Content

How this work-from-home mom gets back-to-school ready with the help of Mac

The back-to-school grind is not for the faint of heart – especially when you’re a parent. We caught up with work-from-home logistics manager and supermom Kim von...

Watch | Rhodes University Marks 120 Years of Academic and Cultural Milestones

Civil Engineering student Zaid’s building blocks to success start with his trusty Mac

Why the iPad is the ultimate study buddy for learners from grades R-12

7 hidden gems to add to your next Aussie escape

Careers24

Is Inflation Eating Your Paycheque? Here’s How to Ask for a Cost of Living Raise and Actually Get...

Navigating a conversation about cost of living adjustments requires tact and preparation. By focusing on the economic factors that impact both the organisation and its...

Unmasking the Surprising Earning Potential of Blue-Collar Work in South Africa

Leveraging AI to Boost Your Job Prospects: A Guide for Modern Job Seekers

Before You Quit: Key Considerations for a Graceful Exit

The Smart Work Manifesto: 8 Strategies for Amplifying Your Productivity Without Burning Out

Property24

Outstanding success at The Terraces’ launch weekend for Steyn City

Steyn City’s newest suburb, The Terraces, has been warmly welcomed by eager buyers, proving that the lifestyle estate is on track to meeting its goal of catering for...

Inspection checklist when buying a fixer-upper

Live your dream: Stunning new Vineyard Villas await at Groot Parys

5 modern and secure townhouses in Gauteng under R3 million

Tips for handling late rental payments

Rand - Dollar

18.92

+0.5%

Rand - Pound

23.67

+0.5%

Rand - Euro

20.30

+0.5%

Rand - Aus dollar

12.36

+0.3%

Rand - Yen

0.12

+1.2%

Platinum

925.60

+0.0%

Palladium

980.50

-1.0%

Gold

2,347.56

+0.7%

Silver

27.60

+0.6%

Brent Crude

89.01

+1.1%

Top 40

69,208

+1.1%

All Share

75,143

+1.1%

Resource 10

62,757

+1.0%

Industrial 25

103,884

+1.3%

Financial 15

15,940

+0.9%

All JSE data delayed by at least 15 minutes

Publications

Publications

Partners

Partners